Condo Insurance in and around Westlake

Townhome owners of Westlake, State Farm has you covered.

Insure your condo with State Farm today

Welcome Home, Condo Owners

Looking for a policy that can help insure both your condo unit and the clothing, cookware, appliances? State Farm offers incredible coverage options you don't want to miss.

Townhome owners of Westlake, State Farm has you covered.

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

Everyone knows having condominium unitowners insurance is essential in case of a fire, windstorm or blizzard. The right amount of condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t left with the bill for a home you can’t occupy. An additional feature of condo unitowners insurance is its ability to protect you in certain legal situations. If someone gets hurt in your home, you could be held responsible for the cost of their recovery or their lost wages. With the right condo coverage, you have liability protection in the event of a covered claim.

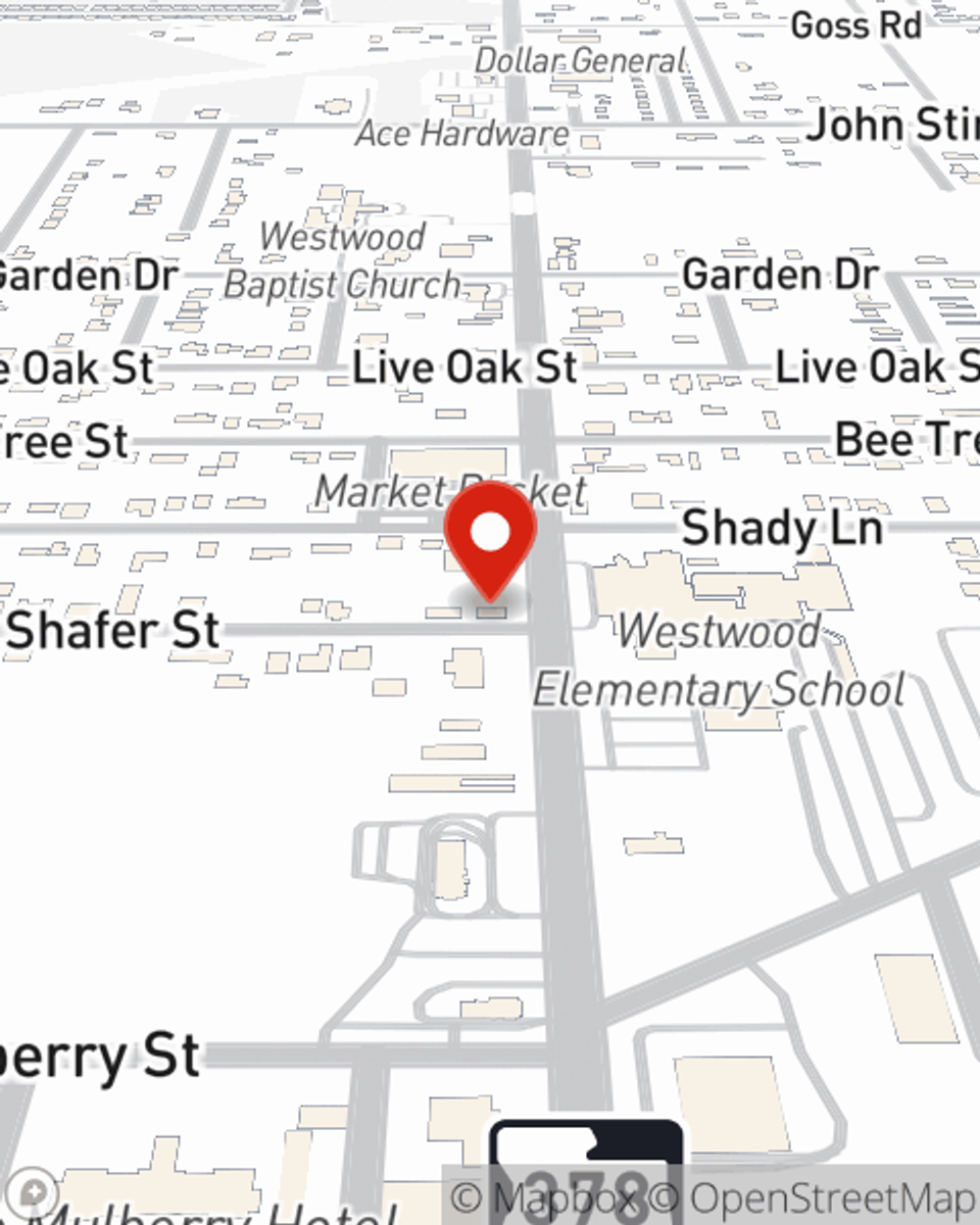

That’s why your friends and neighbors in Westlake turn to State Farm Agent Christina Burleigh. Christina Burleigh can explain your liabilities and help you choose the right level of coverage.

Have More Questions About Condo Unitowners Insurance?

Call Christina at (337) 656-4506 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Christina Burleigh

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.